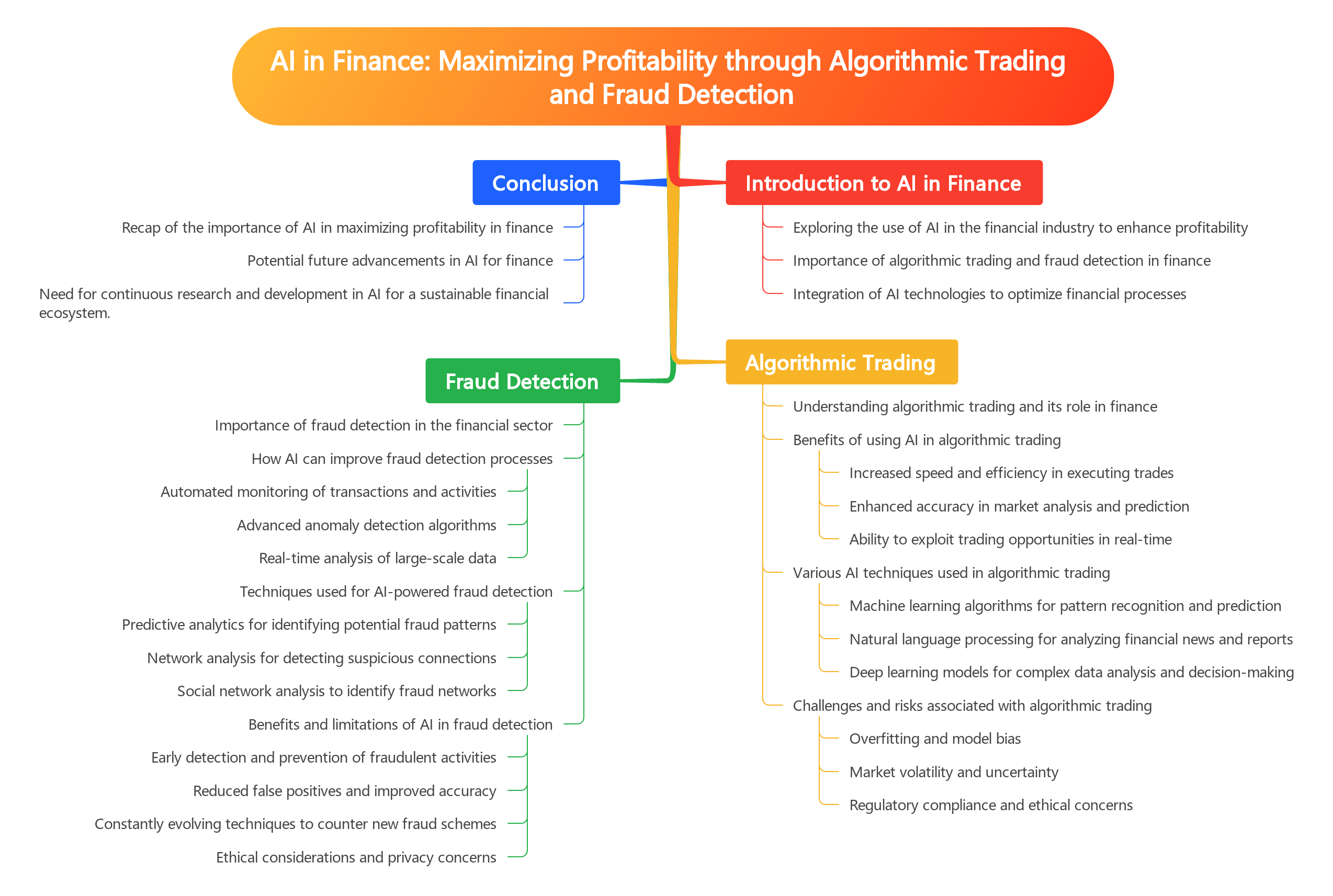

AI In Finance:How To Maximizing Profitability through Algorithmic Trading and Fraud Detection?

1: Introduction to AI in Finance

The Evolution of Artificial Intelligence in the Finance Industry

Artificial intelligence has revolutionized the finance industry in recent years, with applications such as algorithmic trading, fraud detection, and personalized banking services becoming increasingly prevalent. The evolution of AI in finance can be traced back to the early days of machine learning, when basic algorithms were used to automate tasks such as risk assessment and portfolio management. Today, AI has advanced to the point where sophisticated algorithms can analyze vast amounts of data in real-time, making split-second decisions that can have a significant impact on a company’s bottom line.

Algorithmic trading is perhaps the most well-known application of AI in finance, with algorithms capable of executing trades at lightning speed based on predefined criteria. These algorithms can analyze market trends, news stories, and other data points to identify profitable trading opportunities, often in a fraction of a second. This level of automation has enabled financial institutions to execute tradaes with precision and efficiency, resulting in increased profitability and reduced risk.

Fraud detection is another key area where AI has made significant strides in the finance industry. By analyzing patterns in transaction data, AI algorithms can detect anomalies that may indicate fraudulent activity. This has enabled financial institutions to identify and prevent fraudulent transactions in real-time, saving both money and reputation. Additionally, AI can be used to personalize banking services for customers, providing tailored recommendations and advice based on their individual financial goals and preferences.

As AI continues to evolve, its applications in finance will only become more sophisticated. For those who manage the finance industry, it is essential to stay abreast of the latest developments in AI technology and how they can be leveraged to maximize profitability. By embracing AI in finance, companies can gain a competitive edge in a rapidly changing industry, driving innovation and growth in the process.

In conclusion, the evolution of artificial intelligence in the finance industry has been nothing short of transformative. From algorithmic trading to fraud detection and personalized banking services, AI has revolutionized the way financial institutions operate. For those who manage the finance industry, understanding and leveraging AI technology is essential to staying ahead of the curve and maximizing profitability. The future of finance is AI-driven, and those who embrace this technology will reap the rewards of increased efficiency, profitability, and customer satisfaction.

Benefits of AI in Finance

In the world of finance, the use of artificial intelligence (AI) has been steadily increasing, offering a wide range of benefits to those who manage the finances of individuals and businesses. One of the key advantages of AI in finance is its application in algorithmic trading, where computer algorithms analyze market data and execute trades at speeds and frequencies that are impossible for humans to achieve. This can lead to increased profitability and reduced risk for investors.

Furthermore, AI has proven to be highly effective in fraud detection within the financial sector. By analyzing patterns of behavior and identifying anomalies in transactions, AI algorithms can quickly flag potentially fraudulent activity, helping to protect both financial institutions and their customers from losses. This not only saves money but also helps to maintain trust and confidence in the financial system.

Another area where AI is making a significant impact in finance is in personalized banking services. By leveraging machine learning algorithms, financial institutions can analyze customer data to better understand individual needs and preferences, allowing them to offer tailored products and services. This not only improves customer satisfaction but also helps to increase customer loyalty and retention.

Additionally, AI can help financial managers make more informed decisions by providing them with valuable insights and predictions based on data analysis. By utilizing AI tools, finance professionals can better understand market trends, identify potential risks, and optimize investment strategies. This can lead to improved performance and profitability for their clients or organizations.

Overall, the benefits of AI in finance are numerous and far-reaching. From algorithmic trading to fraud detection and personalized banking services, AI is revolutionizing the financial industry and providing those who manage finances with powerful tools to maximize profitability and efficiency. By embracing AI technology, finance professionals can stay ahead of the curve and drive success in a rapidly evolving market.

Challenges of Implementing AI in Finance

Implementing AI in finance comes with its own set of challenges that must be carefully considered in order to maximize the benefits of this technology. One of the main challenges is the integration of AI systems into existing financial infrastructure. Many financial institutions have complex legacy systems that may not easily accommodate new AI technologies. This can result in lengthy and costly integration processes that can hinder the adoption of AI in finance.

Another challenge is the lack of understanding and expertise in AI among finance professionals. Many individuals in the finance industry may not have the necessary skills or knowledge to effectively implement and manage AI systems. This can lead to resistance to change and a reluctance to embrace new technologies that could potentially revolutionize the way financial services are delivered.

Data privacy and security concerns are also significant challenges when it comes to implementing AI in finance. With the vast amounts of sensitive financial data that AI systems require to operate effectively, there is a risk of data breaches and unauthorized access. Financial institutions must ensure that they have robust security measures in place to protect customer information and comply with regulations such as GDPR and PCI DSS.

Another challenge is the potential for bias in AI algorithms. AI systems are only as good as the data they are trained on, and if that data is biased or incomplete, it can lead to inaccurate and unfair outcomes. Financial institutions must be vigilant in monitoring and addressing bias in their AI systems to ensure that they are making decisions that are ethical and unbiased.

Finally, the rapid pace of technological change in the field of AI presents a challenge for financial institutions looking to implement these technologies. Keeping up with the latest developments in AI and ensuring that their systems are up to date and competitive can be a daunting task for those managing finance. However, by overcoming these challenges and embracing the potential of AI in finance, financial institutions can unlock new opportunities for profitability and growth.

2: Algorithmic Trading

Understanding Algorithmic Trading

In the world of finance, algorithmic trading has revolutionized the way trades are executed. Understanding algorithmic trading is crucial for those who manage finances, as it allows for automated trading based on predetermined criteria. This subchapter will delve into the intricacies of algorithmic trading and how it can be leveraged to maximize profitability in the financial markets.

Algorithmic trading involves the use of computer algorithms to execute trades at a speed and frequency that is impossible for human traders to match. These algorithms can analyze vast amounts of data in real-time, identifying trends and making split-second decisions to buy or sell assets. By utilizing algorithms, traders can take advantage of market inefficiencies and exploit opportunities that would be missed by human traders.

One of the key advantages of algorithmic trading is its ability to remove emotion from the trading process. Human traders are often influenced by fear, greed, and other emotions that can lead to irrational decision-making. Algorithms, on the other hand, operate based on logic and predefined rules, ensuring consistent and disciplined trading strategies.

In addition to maximizing profitability, algorithmic trading can also help mitigate risks in the financial markets. By setting strict risk management parameters within the algorithms, traders can limit losses and protect their investments. This proactive approach to risk management is essential for those who manage finances, as it helps to safeguard assets and ensure long-term financial stability.

Overall, understanding algorithmic trading is essential for those who manage finances in today’s fast-paced and highly competitive financial markets. By leveraging the power of algorithms, traders can streamline their trading processes, increase efficiency, and ultimately maximize profitability. With the right knowledge and tools, algorithmic trading can be a powerful asset for those looking to stay ahead in the world of finance.

How AI is Revolutionizing Algorithmic Trading

In recent years, artificial intelligence (AI) has been revolutionizing the field of algorithmic trading. Algorithmic trading involves the use of computer algorithms to make trades in financial markets at speeds and frequencies that are impossible for human traders to achieve. With the advancement of AI technology, algorithmic trading has become even more sophisticated and efficient, allowing finance professionals to maximize profitability and minimize risk.

One of the key ways that AI is revolutionizing algorithmic trading is through the use of machine learning algorithms. These algorithms analyze vast amounts of data from financial markets to identify patterns and trends that human traders may not be able to see. By using machine learning, finance professionals can develop trading strategies that are more accurate and profitable, giving them a competitive edge in the market.

Another way that AI is transforming algorithmic trading is through the use of natural language processing (NLP) technology. NLP allows computers to understand and interpret human language, which can be particularly useful in analyzing news articles, social media posts, and other sources of information that can impact financial markets. By incorporating NLP into algorithmic trading systems, finance professionals can make more informed trading decisions based on real-time data and market sentiment.

AI is also revolutionizing algorithmic trading through the use of predictive analytics. Predictive analytics involves using historical data to forecast future market trends and make trading decisions accordingly. By leveraging AI-powered predictive analytics tools, finance professionals can anticipate market movements with greater accuracy and adjust their trading strategies accordingly, leading to higher profitability and reduced risk.

Overall, AI is playing a crucial role in revolutionizing algorithmic trading by enabling finance professionals to leverage cutting-edge technologies such as machine learning, natural language processing, and predictive analytics. By incorporating AI into their trading strategies, those who manage finance can maximize profitability, minimize risk, and stay ahead of the competition in today’s fast-paced financial markets.

Risks and Ethical Considerations in Algorithmic Trading

In the fast-paced world of finance, algorithmic trading has become increasingly popular among those looking to maximize profitability. However, with the rise of artificial intelligence in finance, there are risks and ethical considerations that must be taken into account. This subchapter will explore some of the key risks and ethical considerations in algorithmic trading for those who manage finance.

One of the main risks associated with algorithmic trading is the potential for errors in the algorithms themselves. These errors can lead to significant financial losses if not caught early on. It is crucial for those managing finance to regularly monitor and update their algorithms to ensure they are functioning correctly and in line with their objectives.

Another risk to consider is the possibility of market manipulation through algorithmic trading. With the ability for algorithms to execute trades at lightning speed, there is a concern that some individuals or organizations may use this technology to manipulate markets for their own gain. Those managing finance must be vigilant in monitoring for any signs of market manipulation and take action to prevent it.

Ethical considerations also come into play when it comes to algorithmic trading. For example, there is a concern that algorithms may inadvertently discriminate against certain groups or individuals based on factors such as race or gender. Those managing finance must ensure that their algorithms are designed in a way that is fair and unbiased to all parties involved.

Additionally, there is a growing concern about the impact of algorithmic trading on market stability. With algorithms making split-second decisions based on complex mathematical models, there is a risk that these decisions could lead to sudden and drastic market movements. Those managing finance must be aware of this risk and take steps to mitigate it through proper risk management practices.

Overall, while algorithmic trading offers many benefits in terms of maximizing profitability, it is important for those managing finance to be aware of the risks and ethical considerations involved. By staying informed and implementing best practices, finance professionals can navigate the world of algorithmic trading with confidence and integrity.

3: Fraud Detection

The Importance of Fraud Detection in Finance

In the world of finance, fraud detection plays a crucial role in protecting the assets and reputation of a company. With the rise of technology and the increasing complexity of financial transactions, the need for effective fraud detection methods has never been more important. This is where artificial intelligence (AI) comes into play, offering advanced algorithms and machine learning capabilities to help detect and prevent fraudulent activities in real-time.

One of the key reasons why fraud detection is so important in finance is the potential financial losses that can occur as a result of fraudulent activities. Whether it’s through credit card fraud, identity theft, or insider trading, the impact of fraud can be devastating to both individuals and businesses. By implementing robust fraud detection systems powered by AI, companies can significantly reduce their risk exposure and protect themselves from potential financial losses.

Furthermore, fraud detection is essential for maintaining the trust and confidence of customers and investors. In today’s digital age, consumers expect their financial information to be secure and protected from fraudsters. By investing in AI-powered fraud detection technologies, finance companies can demonstrate their commitment to safeguarding sensitive data and upholding the highest standards of integrity and transparency.

Another important aspect of fraud detection in finance is regulatory compliance. With strict regulations in place to combat money laundering, terrorist financing, and other illicit activities, companies must have robust fraud detection systems in place to ensure they are meeting their legal obligations. Failure to comply with these regulations can result in hefty fines, reputational damage, and even criminal charges.

In conclusion, the importance of fraud detection in finance cannot be overstated. With the help of AI technologies, companies can enhance their fraud detection capabilities, reduce their risk exposure, protect their assets, and maintain the trust and confidence of their customers and investors. By staying ahead of the curve and investing in cutting-edge fraud detection solutions, finance companies can maximize profitability and achieve long-term success in today’s competitive marketplace.

Traditional Methods vs AI-Powered Fraud Detection

In the world of finance, fraud detection is a critical function that ensures the security and integrity of financial transactions. Traditionally, financial institutions have relied on manual methods to detect and prevent fraud, such as reviewing transaction records and spotting suspicious patterns. While these methods have been effective to some extent, they are time-consuming and often reactive in nature. With the advent of artificial intelligence (AI) technology, however, financial institutions now have access to more powerful tools that can help them detect and prevent fraud in real-time.

AI-powered fraud detection systems utilize advanced algorithms and machine learning techniques to analyze vast amounts of data and identify patterns that may indicate fraudulent activity. These systems can process data at a much faster rate than human analysts and can detect suspicious patterns that may not be apparent to the human eye. By leveraging AI technology, financial institutions can significantly reduce the time and resources required to detect and prevent fraud, ultimately saving money and protecting their customers from financial harm.

One of the key advantages of AI-powered fraud detection systems is their ability to adapt and evolve over time. Traditional fraud detection methods are often static and rely on predefined rules and thresholds to identify suspicious activity. In contrast, AI-powered systems can learn from past data and adjust their algorithms to detect new and emerging fraud patterns. This adaptive nature allows AI-powered systems to stay ahead of fraudsters and continuously improve their detection capabilities.

Another important advantage of AI-powered fraud detection systems is their ability to analyze vast amounts of data in real-time. Traditional methods often struggle to keep pace with the sheer volume of financial transactions that occur on a daily basis. AI-powered systems, on the other hand, can process and analyze large datasets in a matter of seconds, allowing financial institutions to quickly identify and respond to fraudulent activity before it causes significant harm.

Overall, AI-powered fraud detection systems offer a more efficient, effective, and proactive approach to fraud prevention compared to traditional methods. By leveraging the power of AI technology, financial institutions can enhance their fraud detection capabilities, reduce costs, and better protect their customers from financial fraud. As AI continues to advance and evolve, its applications in finance, including fraud detection, will only become more sophisticated and essential for those managing finance in today’s digital age.

Case Studies of Successful Fraud Detection using AI

In this subchapter, we will delve into some fascinating case studies of successful fraud detection using artificial intelligence (AI) in the financial industry. These case studies demonstrate the power of AI in detecting and preventing fraudulent activities, ultimately saving companies millions of dollars in potential losses. As those who manage the finance, it is crucial to understand the impact of AI in fraud detection and how it can enhance the security of financial transactions.

One notable case study involves a leading global bank that implemented AI-powered fraud detection algorithms to monitor its credit card transactions. By analyzing patterns and anomalies in transaction data in real-time, the AI system was able to flag potentially fraudulent activities and alert the bank’s security team. As a result, the bank was able to prevent numerous fraudulent transactions, saving millions of dollars in potential losses and enhancing customer trust in the process.

Another case study showcases a financial services company that leveraged machine learning algorithms to detect fraudulent insurance claims. By analyzing historical data and identifying patterns indicative of fraudulent behavior, the AI system was able to flag suspicious claims for further investigation. This proactive approach not only helped the company reduce its losses due to fraudulent claims but also deterred potential fraudsters from attempting to defraud the company in the future.

Furthermore, a prominent online payment platform utilized AI algorithms to detect and prevent fraudulent activities on its platform. By analyzing user behavior, transaction data, and other relevant variables, the AI system was able to identify suspicious activities in real-time and block fraudulent transactions before they could occur. This proactive approach not only protected the platform from potential losses but also enhanced the overall security and trustworthiness of the platform among its users.

Overall, these case studies demonstrate the immense potential of AI in detecting and preventing fraudulent activities in the financial industry. As those who manage the finance, it is crucial to embrace AI-powered fraud detection technologies to enhance the security of financial transactions and protect your company from potential losses. By leveraging AI algorithms to analyze data and identify patterns indicative of fraudulent behavior, companies can stay one step ahead of fraudsters and safeguard their financial assets effectively.

4: Personalized Banking Services

Enhancing Customer Experience through Personalized Banking

In today’s competitive financial landscape, providing personalized banking services is essential for retaining customers and attracting new ones. AI technology has revolutionized the way banks interact with their customers, allowing for a more tailored and efficient experience. By leveraging AI algorithms and data analytics, banks can gain valuable insights into their customers’ preferences, behaviors, and financial goals. This enables them to offer personalized recommendations, products, and services that meet the unique needs of each individual.

One of the key benefits of personalized banking is enhanced customer experience. By utilizing AI-powered tools, banks can create more personalized interactions with their customers, leading to increased engagement and satisfaction. For example, AI algorithms can analyze customer data to predict their future needs and preferences, allowing banks to proactively offer relevant products and services. This not only improves the overall customer experience but also increases customer loyalty and retention.

Furthermore, personalized banking services can help banks better understand their customers’ financial goals and aspirations. By analyzing customer data and behavioral patterns, banks can identify opportunities to offer tailored financial advice and solutions. This can include personalized investment recommendations, savings goals, and retirement planning strategies. By providing personalized financial guidance, banks can help their customers achieve their long-term financial objectives and build trust and loyalty in the process.

In addition to enhancing customer experience, personalized banking services can also drive profitability for banks. By offering personalized products and services, banks can increase customer engagement and cross-selling opportunities. This can lead to higher conversion rates, increased customer lifetime value, and ultimately, improved profitability. By leveraging AI technology to deliver personalized banking experiences, banks can differentiate themselves in a crowded market and attract and retain high-value customers.

In conclusion, personalized banking services powered by AI technology are essential for managing finance in today’s competitive landscape. By leveraging AI algorithms and data analytics, banks can gain a deeper understanding of their customers’ needs and preferences, leading to enhanced customer experience, increased loyalty, and improved profitability. Those who manage finance must embrace AI in finance to stay ahead of the competition and deliver personalized banking services that meet the unique needs of their customers.

AI-Powered Personalized Recommendations

In the realm of finance, the use of artificial intelligence has revolutionized the way businesses operate. One of the key applications of AI in finance is personalized recommendations. By leveraging advanced algorithms and machine learning techniques, financial institutions can now offer tailored recommendations to customers based on their individual preferences, behavior, and financial goals.

AI-powered personalized recommendations have the potential to significantly enhance customer experience and increase engagement. By analyzing customer data such as transaction history, spending patterns, and investment preferences, AI algorithms can generate targeted recommendations for products and services that are most relevant to each individual customer. This personalized approach not only improves customer satisfaction but also increases the likelihood of cross-selling and upselling opportunities.

Moreover, AI-powered personalized recommendations can help financial institutions better understand their customers and anticipate their needs. By continuously analyzing customer data and behavior, AI algorithms can identify trends and patterns that may not be immediately apparent to human analysts. This enables businesses to proactively offer relevant products and services to customers, ultimately driving customer loyalty and retention.

Furthermore, personalized recommendations can also help financial institutions optimize their marketing strategies. By leveraging AI algorithms to segment customers based on their preferences and behaviors, businesses can tailor their marketing campaigns to target specific customer segments more effectively. This targeted approach can lead to higher conversion rates and increased ROI on marketing efforts.

Overall, AI-powered personalized recommendations represent a powerful tool for financial institutions looking to enhance customer experience, drive engagement, and increase profitability. By leveraging the capabilities of AI algorithms, businesses can offer relevant and timely recommendations to customers, ultimately improving customer satisfaction and loyalty. As AI continues to advance, personalized recommendations will play an increasingly important role in shaping the future of finance.

The Future of Personalized Banking Services

The future of personalized banking services is one that is heavily reliant on the integration of artificial intelligence and machine learning technology. As financial institutions seek to provide more tailored and convenient services to their customers, AI has emerged as a powerful tool in achieving this goal. By analyzing vast amounts of data on individual spending habits, financial goals, and risk tolerance, AI algorithms can provide personalized recommendations for banking services that are tailored to each customer’s unique needs.

One of the key benefits of personalized banking services powered by AI is the ability to offer more targeted financial advice and products. For example, AI algorithms can analyze a customer’s spending patterns and recommend personalized budgeting tools or investment options that align with their financial goals. This level of customization not only enhances the customer experience but also helps financial institutions build stronger relationships with their clients by demonstrating a deep understanding of their individual needs.

In addition to personalized recommendations, AI can also enhance security and fraud detection in banking services. By continuously monitoring customer transactions and behavior patterns, AI algorithms can quickly identify and flag any suspicious activity, helping to prevent fraud before it occurs. This proactive approach to fraud detection not only protects customers from financial loss but also helps financial institutions maintain their reputation and credibility in the market.

Furthermore, the future of personalized banking services will likely see an increase in the use of chatbots and virtual assistants to provide real-time customer support and assistance. These AI-powered tools can help customers with account inquiries, transaction history, or even financial planning advice, all without the need for human intervention. This level of convenience and accessibility is crucial in today’s fast-paced digital world, where customers expect instant responses and personalized service.

Overall, the future of personalized banking services is bright, thanks to the advancements in AI technology. By leveraging the power of artificial intelligence, financial institutions can offer more tailored and convenient services to their customers, enhance security and fraud detection measures, and provide real-time customer support through chatbots and virtual assistants. Those who manage finance must embrace these innovations to stay competitive in an increasingly digital and data-driven industry.

5: Maximizing Profitability with AI

Leveraging AI for Investment Strategies

In today’s rapidly evolving financial landscape, the use of artificial intelligence (AI) has become increasingly prevalent in the realm of investment strategies. By leveraging AI, financial professionals can gain a competitive edge in the market and maximize profitability. This subchapter will delve into the various ways in which AI can be utilized to enhance investment strategies, including algorithmic trading, fraud detection, and personalized banking services.

Algorithmic trading is one of the most popular applications of AI in finance. By utilizing complex algorithms and machine learning models, financial professionals can automate the process of buying and selling assets based on predefined rules and criteria. This not only allows for faster and more efficient trading, but also reduces the risk of human error. AI-powered trading systems can analyze vast amounts of data in real time, identify patterns and trends, and execute trades at optimal times to maximize returns.

Another key application of AI in finance is fraud detection. With the rise of digital transactions and online banking, the risk of fraudulent activities has also increased. AI algorithms can be trained to detect suspicious patterns and anomalies in financial transactions, enabling financial institutions to flag and investigate potential fraudulent activities in real time. By leveraging AI for fraud detection, financial professionals can protect their clients’ assets and maintain the integrity of the financial system.

In addition to algorithmic trading and fraud detection, AI can also be utilized to provide personalized banking services to clients. By analyzing customers’ financial data and behavior patterns, AI-powered systems can offer tailored investment advice, recommend personalized financial products, and provide customized financial planning services. This not only enhances the overall customer experience, but also helps financial professionals build stronger relationships with their clients and drive customer loyalty.

Overall, the use of AI in investment strategies has the potential to revolutionize the financial industry and drive profitability for those who manage finance. By leveraging AI for algorithmic trading, fraud detection, and personalized banking services, financial professionals can stay ahead of the curve, make informed investment decisions, and ultimately maximize returns for their clients. In this subchapter, we will explore the various ways in which AI can be harnessed to enhance investment strategies and drive success in the ever-changing world of finance.

Using AI to Optimize Risk Management

In today’s fast-paced world of finance, managing risk effectively is crucial for the success of any organization. With the advancements in artificial intelligence (AI) technology, finance professionals now have powerful tools at their disposal to optimize risk management processes. By harnessing the capabilities of AI, organizations can gain valuable insights into market trends, identify potential risks, and make more informed decisions to protect their assets and investments.

One of the key applications of AI in risk management is algorithmic trading. By using sophisticated algorithms and machine learning models, finance professionals can automate the process of buying and selling securities based on predefined criteria. This not only helps to reduce human error but also allows organizations to react quickly to market fluctuations and capitalize on profitable opportunities. With AI-powered algorithmic trading, finance professionals can optimize their trading strategies, minimize risks, and maximize returns on investment.

Another important application of AI in risk management is fraud detection. With the rise of digital transactions and online banking, financial institutions are increasingly vulnerable to fraudulent activities. AI-powered fraud detection systems can analyze vast amounts of transaction data in real-time, identify suspicious patterns or anomalies, and flag potential cases of fraud. By leveraging AI technology, organizations can detect fraudulent activities more effectively, protect their customers’ assets, and maintain their reputation in the market.

Personalized banking services are also benefiting from AI in risk management. By using AI algorithms to analyze customer data and behavior patterns, financial institutions can offer personalized recommendations and tailored services to their clients. This not only enhances customer satisfaction but also helps to identify potential risks or issues before they escalate. By leveraging AI to provide personalized banking services, organizations can build stronger relationships with their customers, increase customer loyalty, and mitigate risks associated with financial transactions.

In conclusion, AI technology is revolutionizing the way finance professionals manage risk in today’s dynamic market environment. By utilizing AI-powered tools and algorithms, organizations can optimize their risk management processes, improve decision-making, and achieve better outcomes in terms of profitability and security. Those who manage finance must embrace AI in risk management to stay ahead of the competition and navigate the complexities of the financial landscape with confidence and efficiency.

Case Studies of Companies Maximizing Profitability through AI

In this subchapter, we will delve into case studies of companies that have successfully leveraged artificial intelligence (AI) to maximize profitability in the finance sector. These companies have utilized AI in various ways, such as algorithmic trading, fraud detection, and personalized banking services, to gain a competitive edge and drive financial success. By examining these case studies, finance professionals can gain valuable insights into how AI can be effectively implemented to enhance profitability and improve overall business performance.

One such case study is that of a leading asset management firm that implemented AI-powered algorithmic trading strategies to increase trading efficiency and profitability. By utilizing advanced machine learning algorithms, the firm was able to analyze market data in real-time, identify profitable trading opportunities, and execute trades at lightning speed. This resulted in improved trading performance, reduced trading costs, and ultimately, higher returns for investors. The firm’s successful implementation of AI in algorithmic trading serves as a testament to the potential of AI to revolutionize the finance industry.

Another notable case study is that of a global bank that deployed AI-powered fraud detection systems to combat financial crime and protect its customers’ assets. By leveraging AI algorithms to analyze transaction data, identify suspicious patterns, and flag potentially fraudulent activities, the bank was able to significantly reduce fraud losses and enhance security measures. This not only safeguarded the bank’s reputation but also instilled trust and confidence among its customers. The successful implementation of AI in fraud detection highlights the importance of using cutting-edge technology to mitigate risks and protect financial assets.

Furthermore, we will explore a case study of a fintech startup that utilized AI to offer personalized banking services to its customers. By leveraging machine learning algorithms to analyze customer data, understand individual preferences, and tailor financial products and services to meet specific needs, the startup was able to enhance customer satisfaction, increase customer retention, and drive revenue growth. The personalized banking services offered by the startup not only differentiated it from competitors but also attracted a loyal customer base. This case study exemplifies the power of AI in delivering customized solutions that resonate with customers and drive business success.

In conclusion, these case studies demonstrate the transformative impact of AI on the finance industry and how companies can maximize profitability through the strategic implementation of AI technologies. By adopting AI-powered solutions in areas such as algorithmic trading, fraud detection, and personalized banking services, finance professionals can unlock new opportunities for growth, innovation, and competitive advantage. As AI continues to evolve and reshape the finance landscape, it is essential for finance professionals to stay informed and proactive in leveraging AI to drive profitability and achieve sustainable business success.

6: Implementing AI in Finance

Steps to Successfully Implement AI in Finance

In today’s fast-paced financial industry, the successful implementation of artificial intelligence (AI) is crucial for staying ahead of the competition and maximizing profitability. AI has revolutionized the way finance professionals approach tasks such as algorithmic trading, fraud detection, and personalized banking services. However, implementing AI in finance is not without its challenges. In this subchapter, we will discuss the steps that those who manage finance can take to successfully implement AI in their organizations.

The first step to successfully implementing AI in finance is to clearly define the goals and objectives of the project. Whether the goal is to increase trading efficiency, reduce fraud, or improve customer satisfaction, it is important to have a clear understanding of what success looks like. This will help guide the implementation process and ensure that the AI technology is aligned with the organization’s overall strategic objectives.

Once the goals and objectives have been established, the next step is to conduct a thorough assessment of the organization’s current capabilities and resources. This includes evaluating the existing data infrastructure, technology systems, and talent pool. It is important to identify any gaps or limitations that may hinder the successful implementation of AI and take steps to address them proactively.

After assessing the organization’s capabilities, the next step is to identify the right AI technologies and tools that will best meet the organization’s needs. This may involve conducting research, consulting with experts, and evaluating different vendors. It is important to choose AI technologies that are scalable, flexible, and easy to integrate with existing systems. Additionally, it is crucial to ensure that the chosen AI technologies comply with relevant regulations and industry standards.

Once the AI technologies have been selected, the next step is to develop a detailed implementation plan. This plan should outline the timeline, milestones, and resources required to successfully deploy the AI technologies. It is important to involve key stakeholders from across the organization in the planning process to ensure alignment and buy-in. Regular communication and updates throughout the implementation process are also key to ensuring that the project stays on track and achieves its objectives.

Finally, the last step in successfully implementing AI in finance is to continuously monitor and evaluate the performance of the AI technologies. This involves tracking key performance indicators, analyzing data, and making adjustments as needed to optimize performance. By following these steps and remaining agile and adaptable, those who manage finance can successfully implement AI technologies in their organizations and unlock their full potential for maximizing profitability through algorithmic trading and fraud detection.

Overcoming Resistance to AI Adoption in Finance

In the world of finance, the adoption of artificial intelligence (AI) has the potential to revolutionize the way businesses operate. From algorithmic trading to fraud detection and personalized banking services, AI offers a wide range of applications that can streamline processes, increase efficiency, and ultimately maximize profitability. However, despite the numerous benefits that AI can bring to the finance industry, there is often resistance to its adoption.

One common reason for resistance to AI adoption in finance is the fear of job loss. Many employees worry that AI will replace their roles, leading to unemployment and job insecurity. However, it is important to remember that AI is meant to augment human capabilities, not replace them. By automating routine tasks and providing valuable insights, AI can free up employees to focus on more strategic and high-value activities, ultimately enhancing their job satisfaction and performance.

Another reason for resistance to AI adoption in finance is the lack of understanding or familiarity with the technology. Many finance professionals may be hesitant to embrace AI because they do not fully understand how it works or how it can benefit their organization. To overcome this resistance, education and training on AI technologies are essential. By providing employees with the knowledge and skills they need to effectively leverage AI tools, organizations can help them see the value that AI can bring to their work.

Additionally, concerns about data privacy and security can also hinder the adoption of AI in finance. Many finance professionals worry that AI systems may compromise sensitive financial information or expose their organization to cyber threats. To address these concerns, organizations must prioritize data security and compliance when implementing AI solutions. By implementing robust data protection measures and ensuring compliance with industry regulations, organizations can build trust with employees and customers and alleviate fears about data security.

In conclusion, overcoming resistance to AI adoption in finance requires a combination of education, communication, and strategic planning. By addressing concerns about job loss, providing training on AI technologies, and prioritizing data security, organizations can successfully implement AI solutions that maximize profitability and drive innovation in the finance industry. Ultimately, embracing AI in finance offers numerous benefits that can help organizations stay competitive in a rapidly evolving market.

Training and Upskilling Finance Professionals in AI

In today’s rapidly evolving financial landscape, the role of artificial intelligence (AI) in finance has become increasingly important. One of the key areas where AI is making a significant impact is in the training and upskilling of finance professionals. In this subchapter, we will explore the various ways in which finance professionals can enhance their skills and knowledge in AI to stay ahead of the curve.

The first step in training finance professionals in AI is to provide them with a solid foundation in the fundamentals of AI and machine learning. This includes understanding the basic concepts, algorithms, and techniques used in AI applications in finance. By gaining a strong understanding of these core principles, finance professionals can begin to see how AI can be applied to their specific roles and responsibilities.

Once finance professionals have a solid understanding of the fundamentals of AI, the next step is to provide them with hands-on training and practical experience. This can be done through workshops, seminars, and online courses that focus on real-world applications of AI in finance. By getting hands-on experience with AI tools and techniques, finance professionals can gain the confidence and skills needed to effectively implement AI solutions in their daily work.

In addition to technical training, it is also important to provide finance professionals with opportunities for continuous learning and upskilling in AI. This can be done through ongoing professional development programs, mentorship opportunities, and networking events that focus on AI in finance. By staying up-to-date on the latest trends and developments in AI, finance professionals can ensure that they are always at the forefront of innovation in their field.

Overall, training and upskilling finance professionals in AI is essential for maximizing profitability through algorithmic trading and fraud detection. By providing finance professionals with a solid foundation in AI, hands-on training, and opportunities for continuous learning, organizations can ensure that their teams are well-equipped to leverage the power of AI in finance and drive success in today’s competitive market.

7: The Future of AI in Finance

Emerging Trends in AI for Finance

In recent years, the finance industry has seen a rapid increase in the adoption of artificial intelligence (AI) technologies to enhance decision-making processes, improve efficiency, and minimize risks. One of the emerging trends in AI for finance is algorithmic trading, which involves the use of complex algorithms to execute high-speed trades in financial markets. These algorithms can analyze vast amounts of data and make split-second decisions to capitalize on market opportunities, ultimately maximizing profitability for financial institutions.

Another significant trend in AI for finance is fraud detection, where machine learning algorithms are used to identify suspicious activities and prevent fraudulent transactions. By analyzing patterns in transaction data and detecting anomalies in real-time, AI systems can help financial institutions combat fraud more effectively than traditional methods. This not only protects the institution’s assets but also enhances customer trust and loyalty.

Personalized banking services are also becoming increasingly popular in the finance industry, thanks to advancements in AI technology. By leveraging customer data and machine learning algorithms, financial institutions can offer personalized recommendations, tailored products, and customized services to meet the unique needs and preferences of individual customers. This not only improves the overall customer experience but also increases customer retention and loyalty in the long run.

Moreover, AI-powered chatbots are revolutionizing customer service in the finance industry by providing real-time assistance and support to customers. These chatbots are equipped with natural language processing capabilities, enabling them to understand and respond to customer queries and requests promptly. By automating routine tasks and providing personalized assistance, chatbots help financial institutions streamline operations, reduce costs, and enhance customer satisfaction.

Overall, the emerging trends in AI for finance are reshaping the industry landscape and providing new opportunities for financial institutions to maximize profitability, improve efficiency, and deliver superior customer experiences. As AI technology continues to evolve and mature, those who manage finance must stay informed and embrace these trends to stay competitive in an increasingly digital and data-driven world.

Ethical Considerations and Regulations in AI for Finance

In the rapidly evolving world of finance, artificial intelligence (AI) has become a powerful tool for maximizing profitability and efficiency. However, as with any technology, there are ethical considerations and regulations that must be taken into account when implementing AI in finance. It is crucial for those managing finance to understand and address these considerations to ensure that AI is being used responsibly and ethically.

One of the primary ethical considerations in AI for finance is the potential for bias in algorithms. AI systems are only as good as the data they are trained on, and if that data is biased, the algorithms will produce biased results. This can lead to unfair treatment of certain individuals or groups, which can have serious consequences in the financial industry. It is essential for those managing finance to carefully monitor and address bias in AI algorithms to ensure fair and equitable outcomes for all stakeholders.

Another important ethical consideration in AI for finance is transparency. AI algorithms can be complex and difficult to understand, making it challenging for individuals to know how decisions are being made. This lack of transparency can lead to distrust and confusion among customers and regulators. Those managing finance must prioritize transparency in AI systems, providing clear explanations of how algorithms work and ensuring that decisions are made in a way that is understandable and accountable.

In addition to ethical considerations, regulations also play a crucial role in the use of AI in finance. Regulators around the world are increasingly focused on ensuring that AI systems in finance are used responsibly and in compliance with existing laws and regulations. Those managing finance must stay up to date on the latest regulations and ensure that their AI systems are in compliance to avoid potential legal and financial consequences.

Overall, ethical considerations and regulations are essential aspects of implementing AI in finance. By addressing bias, prioritizing transparency, and staying compliant with regulations, those managing finance can ensure that AI is used responsibly and ethically to maximize profitability and efficiency in the financial industry. It is crucial for those in finance to prioritize ethical considerations and regulations in the use of AI to build trust with customers, regulators, and other stakeholders.

Predictions for the Future of AI in Finance

In this subchapter, we will explore some predictions for the future of AI in finance. As those who manage the finance industry, it is crucial to stay ahead of the curve and understand how AI will continue to shape the industry in the years to come. One major prediction is that AI will become even more prevalent in algorithmic trading. With advancements in machine learning and natural language processing, AI algorithms will be able to analyze vast amounts of data and make split-second decisions that can lead to increased profits for financial institutions.

Another prediction for the future of AI in finance is the continued growth of fraud detection systems. As cyber threats become more sophisticated, AI-powered fraud detection tools will be essential in protecting sensitive financial information. These systems will be able to detect anomalies in real-time and flag potentially fraudulent transactions before they can cause harm. By leveraging AI technologies, financial institutions can stay one step ahead of cybercriminals and protect their customers’ assets.

Personalized banking services are also set to benefit from AI advancements in the future. By leveraging data analytics and machine learning, financial institutions can offer more tailored products and services to their customers. AI algorithms can analyze spending habits, investment preferences, and risk tolerance levels to provide personalized recommendations that meet the unique needs of each individual. This level of customization can lead to increased customer satisfaction and loyalty, ultimately driving profitability for financial institutions.

Furthermore, AI will play a crucial role in regulatory compliance in the finance industry. As regulations become more complex and stringent, AI-powered solutions will be essential in ensuring that financial institutions are in compliance with all relevant laws and regulations. By automating compliance processes and flagging potential issues, AI can help reduce the risk of fines and penalties for non-compliance. This will not only save time and resources for financial institutions but also help them maintain a positive reputation in the eyes of regulators and customers.

In conclusion, the future of AI in finance is bright and full of possibilities. By embracing AI technologies in algorithmic trading, fraud detection, personalized banking services, and regulatory compliance, financial institutions can unlock new opportunities for growth and profitability. As those who manage the finance industry, it is crucial to stay informed about these advancements and leverage AI to stay ahead of the competition. By understanding and embracing the potential of AI in finance, we can maximize profitability and drive success in the ever-evolving financial landscape.

8: Conclusion

Recap of Key Points

In this subchapter, we will recap some of the key points discussed in the book “AI in Finance: Maximizing Profitability through Algorithmic Trading and Fraud Detection.” This book is essential for those who manage finance and are interested in utilizing AI technology to enhance profitability and efficiency in their organizations. We have explored various applications of AI in finance, including algorithmic trading, fraud detection, and personalized banking services.

First and foremost, algorithmic trading is a crucial component of AI in finance. By utilizing complex algorithms and machine learning models, financial institutions can automate trading decisions and execute trades at lightning speed. This not only reduces human error but also allows for more efficient and profitable trading strategies. It is important for finance managers to understand the potential benefits and risks associated with algorithmic trading in order to make informed decisions for their organizations.

Secondly, fraud detection is another key application of AI in finance. With the increasing prevalence of financial fraud, it is essential for organizations to have robust fraud detection systems in place. AI-powered fraud detection tools can analyze vast amounts of data in real-time to identify suspicious activities and prevent fraudulent transactions. Finance managers should prioritize implementing AI-based fraud detection systems to protect their organizations and clients from potential financial losses.

Lastly, personalized banking services are revolutionizing the way financial institutions interact with their customers. By leveraging AI technology, banks can offer customized financial products and services based on individual preferences and behavior patterns. This not only improves customer satisfaction but also helps increase customer loyalty and retention. Finance managers should explore the possibilities of personalized banking services to stay competitive in the ever-evolving financial industry.

In conclusion, AI in finance offers a myriad of opportunities for organizations to maximize profitability and efficiency. By understanding the key applications of AI in finance, such as algorithmic trading, fraud detection, and personalized banking services, finance managers can harness the power of AI to drive growth and innovation within their organizations. It is crucial for finance managers to stay informed and proactive in adopting AI technology to stay ahead of the curve in today’s rapidly changing financial landscape.

Final Thoughts on the Impact of AI in Finance

As we come to the end of this book, it is important to reflect on the impact that AI has had on the finance industry. The applications of AI in finance, such as algorithmic trading, fraud detection, and personalized banking services, have revolutionized the way we approach financial decision-making. By leveraging the power of algorithms and machine learning, financial institutions have been able to maximize profitability and minimize risk in ways that were previously unimaginable.

One of the most significant impacts of AI in finance has been in the realm of algorithmic trading. By using complex mathematical models and historical data to make decisions about buying and selling financial instruments, AI has enabled traders to execute trades at lightning speed and with a level of precision that is simply not possible for human traders. This has led to increased liquidity in the markets and more efficient pricing, ultimately benefiting both investors and the economy as a whole.

Another area where AI has had a profound impact is in fraud detection. By analyzing vast amounts of data in real-time, AI algorithms are able to detect patterns and anomalies that may indicate fraudulent activity. This has helped financial institutions to identify and prevent fraud more effectively, saving them millions of dollars in potential losses. Additionally, AI has also been used to personalize banking services, providing customers with tailored recommendations and services based on their individual financial needs and preferences.

As those who manage the finance industry, it is crucial to embrace the opportunities that AI presents while also being mindful of the challenges it may bring. While AI has the potential to revolutionize the way we do business, it also raises important ethical and regulatory considerations that must be carefully navigated. It is essential for financial institutions to invest in the necessary infrastructure and talent to effectively leverage AI technologies while also ensuring that they are used responsibly and ethically.

In conclusion, the impact of AI in finance has been profound and far-reaching. By harnessing the power of algorithms and machine learning, financial institutions have been able to streamline operations, reduce costs, and improve decision-making processes. However, it is important for those who manage the finance industry to approach AI with caution and foresight, ensuring that it is used in a way that benefits both customers and society as a whole.

Recommendations for Finance Professionals looking to Embrace AI

In today’s fast-paced financial industry, the integration of artificial intelligence (AI) has become essential for those looking to stay ahead of the curve. Finance professionals who want to embrace AI must first understand its applications in the industry, such as algorithmic trading, fraud detection, and personalized banking services. To successfully leverage AI in finance, here are some key recommendations for finance professionals:

First and foremost, finance professionals must invest in their knowledge of AI technologies and how they can be applied in the financial sector. This can be achieved through attending workshops, seminars, and online courses that focus on AI in finance. By staying informed on the latest developments in AI, finance professionals can make more informed decisions when implementing AI solutions in their organizations.

Secondly, finance professionals should collaborate with data scientists and AI experts to develop and implement AI-driven solutions in their organizations. By working closely with these experts, finance professionals can ensure that AI technologies are being used effectively and efficiently to maximize profitability and minimize risk. Additionally, collaborating with AI experts can help finance professionals stay up-to-date on the latest advancements in AI technologies.

Another key recommendation for finance professionals looking to embrace AI is to prioritize data security and privacy. As AI technologies rely heavily on data, it is crucial for finance professionals to implement robust security measures to protect sensitive financial information. By prioritizing data security and privacy, finance professionals can build trust with their clients and stakeholders and avoid potential data breaches that could negatively impact their organization.

Furthermore, finance professionals should continuously monitor and evaluate the performance of AI-driven solutions in their organizations. By collecting and analyzing data on the effectiveness of AI technologies, finance professionals can identify areas for improvement and make necessary adjustments to optimize their AI strategies. Regular performance evaluations can help finance professionals ensure that their AI solutions are delivering the desired results and contributing to the overall profitability of their organization.

In conclusion, finance professionals looking to embrace AI must prioritize knowledge, collaboration, data security, and performance evaluation. By following these recommendations, finance professionals can successfully leverage AI technologies to maximize profitability through algorithmic trading, fraud detection, and personalized banking services. With the right approach and mindset, finance professionals can position themselves as leaders in the integration of AI in the financial industry.